Macau Casinos Eye Steady Growth and Premium Focus in 2026

Macau’s casino sector is expected to sustain a steady upward trajectory in 2026, according to a UBS assessment, signaling resilience rather than rapid recovery after the post-pandemic rebound. Analysts highlight that the market’s growth is grounded in long-term trends, not temporary spikes.

UBS forecasts gross gaming revenue in Macau to climb around 6% next year, with overall industry EBITDA rising roughly 7%. Growth is expected to be stronger in the first half, around 7% year-on-year, before moderating to about 4% in the latter half as the base effect eases.

Key Drivers of Stability

The city’s positive outlook is supported by improvements in tourism infrastructure, expanded marketing initiatives and a more varied visitor base. These developments are expected to particularly benefit premium players, who continue to be the core contributors to Macau’s gaming revenue.

Despite recent downward revisions to EBITDA estimates due to higher operating costs in late 2025, UBS expects margins to remain largely stable. Some demand has shifted from satellite casinos to major concessionaires, but competition is described as controlled and predictable rather than aggressive.

Premium Segment Remains Central

High-spending visitors remain the focus for Macau operators, with stable competition among premium offerings. Promotions mainly affect mass-market segments, leaving the high-end market relatively insulated. Reinvestment in experiences, loyalty programs and upgraded amenities for premium guests continues at a steady pace.

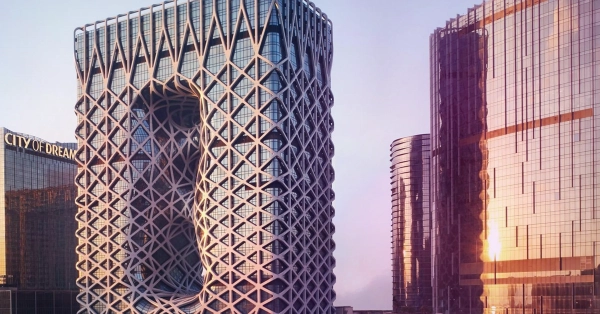

Several major operators are enhancing their properties: MGM China and Wynn Macau plan to open new suites early in 2026, while Melco Resorts is revamping its Countdown Hotel by mid-year. These investments are designed to maintain Macau’s appeal to top-tier clientele.

A Mature, Resilient Market

UBS concludes that Macau’s gaming sector is entering a more mature phase, with growth concentrated on consolidation rather than volatility. With sustained tourism demand, refined marketing and continuous premium property enhancements, the city is reinforcing its position as a resilient and strategically managed global gaming hub.