Macau Gaming Revenue Shows Strong Recovery in January 2026

Macau’s casino market is showing clear signs of a rebound after closing 2025 on a softer note. According to analysis from Seaport Research Partners, gaming revenue in the first days of January has accelerated sharply, with daily takings during the January 1–4 holiday stretch potentially topping MOP$850 million.

That level represents a marked improvement on December’s performance. The final month of 2025 generated MOP$20.89 billion (US$2.61 billion) in gross gaming revenue, translating to a daily average of about MOP$674 million. December fell short of expectations largely due to weak VIP hold, which dragged results below consensus forecasts.

The strong January opening is particularly notable given that Lunar New Year falls later in the calendar this year, running from February 16 to 22. Seaport expects Macau’s January gaming revenue to rise around 19 percent year-on-year, with a roughly 4 percent sequential increase from the prior month, helped by easier comparison periods. Momentum is forecast to extend into the first quarter, with Q1 gross gaming revenue projected to climb more than 14 percent. For full-year 2026, Seaport estimates growth of approximately 7 percent.

Structural Tailwinds Support the Outlook

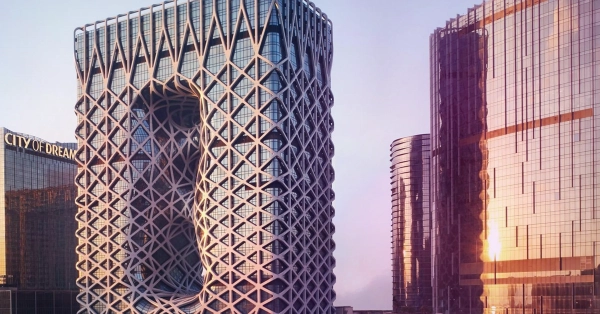

Several underlying factors are supporting this more optimistic trajectory. Easier year-on-year comparisons during the first half of 2026 create a favorable baseline. At the same time, looser controls on money movement and more flexible visa policies are expected to lift visitation levels. Seaport senior analyst Vitaly Umansky noted that any improvement in overnight base mass play still well below pre-pandemic levels could provide additional upside, particularly for operators with larger hotel inventories.

Potential Market Share Gains for Major Operators

Umansky expects larger concessionaires to benefit most from the improving environment. Sands China and Galaxy Entertainment Group are forecast to gain share relative to smaller rivals, given their scale, infrastructure and capacity to accommodate rising demand. As more visitors shift from day trips to overnight stays, operators with significant room supply are better positioned to capture incremental gaming spend alongside non-gaming revenue streams.

The early January performance supports that view. Daily revenue exceeding MOP$850 million represents an increase of roughly 26 percent compared with December’s average. Even if that pace eases slightly, January results could still align with Seaport’s projected 19 percent growth rate. Sustained strength through the first quarter would reinforce the firm’s broader outlook for the year.

Why Analysts Are Cautiously Optimistic

The recovery is being driven by both seasonal and structural factors. Relaxed visa requirements have made travel to Macau easier for mainland visitors, while the operating environment for gaming-related financial transactions has become less restrictive than in previous years. Together, these shifts are creating conditions that support higher discretionary spending.

The base mass segment remains the key growth lever. While day visitors contribute volume, overnight guests typically deliver higher value through longer play and additional spending on accommodation, dining and entertainment. Sands China and Galaxy have spent years building integrated resort capacity designed to capitalize on this shift, positioning them well as travel patterns continue to evolve.

Encouraging Start Sets the Tone for 2026

January’s strong opening provides reassurance after December’s softer finish. If Seaport’s projections materialize, 2026 should mark another year of expansion for Macau, though at a more moderate pace than the initial post-pandemic rebound. First-quarter growth near 14 percent would establish a solid foundation, while full-year growth of around 7 percent reflects a more mature market with fewer calendar-driven boosts. For now, the early holiday figures suggest the sector is entering the Lunar New Year period with renewed momentum.