Macau Gaming Revenues Set to Rise 13% in October

Macau’s gaming sector is on course for its strongest performance in six years, with analysts projecting a 13% rise in gross gaming revenue (GGR) for October 2025. The surge comes as travel and visa restrictions ease across mainland China, alongside a vibrant calendar of festivals and events fueling tourism.

Recent data from the Gaming Inspection and Coordination Bureau (DICJ) showed September’s GGR at MOP18.3 billion (US$2.28 billion) slightly below forecasts. However, analysts attribute the decline mainly to Super Typhoon Ragasa, which forced casino closures for 33 hours and disrupted major transport links. According to JP Morgan, the storm likely shaved up to 10% off the month’s total, meaning that, without the weather impact, Macau would have achieved another month of double-digit growth.

Q3 Momentum Builds into Record October

Despite the temporary dip, the third quarter of 2025 recorded Macau’s strongest results since the pandemic, generating MOP62.2 billion (US$7.75 billion) in gaming revenue 13% higher year-on-year and 2% up from Q2.

JP Morgan analysts DS Kim, Selina Li, and Lindsey Qian expect this momentum to continue into October, boosted by Golden Week celebrations and high tourist inflows.

Preliminary figures suggest daily GGR exceeding MOP1.1 billion (US$137 million), approaching pre-COVID Golden Week highs of MOP1.16 billion (US$145 million). After the holiday, sustained demand could keep daily revenues around MOP750–760 million (US$93–95 million), representing solid mid-to-high double-digit growth compared to last year.

Analysts now forecast monthly GGR above MOP23 billion (US$2.87 billion) , the highest total since 2019.

Optimism Tempered by Potential Typhoon Risks

Research firm Seaport Research Partners shares a similar 13% year-on-year growth projection, while cautioning against possible typhoon disruptions in the coming months.

Analyst Vitaly Umansky cited sustained marketing campaigns, looser capital controls, and consistent visa approvals as key catalysts behind Macau’s continued rebound. He also noted that a potential U.S.–China trade breakthrough could lift consumer confidence and support spending in the entertainment and hospitality sectors.

Liquidity and Consumer Sentiment Drive Long-Term Growth

Experts agree that liquidity among premium and upper-middle-tier customers remains Macau’s most important growth driver. As long as financial channels stay open and visitor confidence remains high, Macau’s casinos are expected to maintain momentum.

Projections for 2025 overall point to 8.4% annual GGR growth, while the final quarter could deliver as much as 12.4% growth, underpinned by robust tourism and steady premium play.

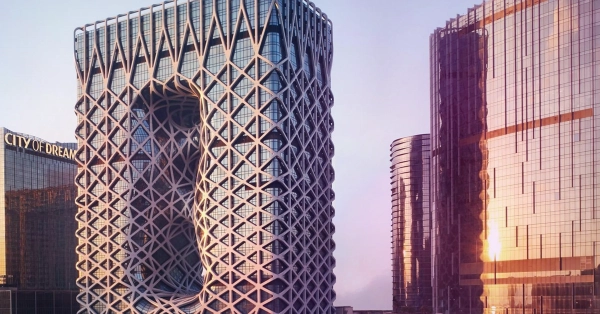

Macau Reclaims Its Status as Asia’s Entertainment Capital

Despite a weather related setback, Macau’s casino industry appears firmly on track for a strong rebound. The city’s recovery is powered by travel normalization, vibrant event programming, and high-end liquidity, setting the stage for its best year since pre-pandemic times.

With renewed investor confidence, steady inflows of visitors, and support from Beijing’s policy relaxations, Macau is once again asserting its dominance as the premier gaming and entertainment destination in Asia.