SJM Holdings Raises $540M via Senior Notes Amid Macau Shift

Macau gaming firm SJM Holdings has raised $540 million through a senior notes issuance to strengthen its balance sheet amid ongoing regulatory adjustments. The bonds carry a 6.6% coupon and mature in 2031. Proceeds will also fund a cash offer to repurchase 2026 notes via its subsidiary Champion Path Holdings Ltd.

Debt Strategy and Market Context

The bond sale aims to extend SJM’s debt maturities and provide greater financial flexibility, allowing the company to manage upcoming obligations without immediate refinancing pressure. The notes were arranged with a consortium of banks from Hong Kong, Macau and Singapore, with STDM, SJM’s controlling shareholder, subscribing to a portion of the issuance.

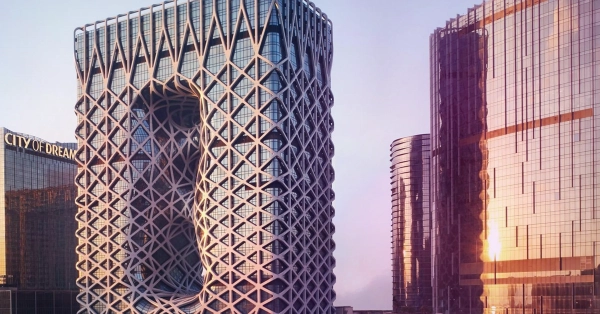

The timing reflects recent regulatory shifts in Macau, including the closure of all satellite casinos by the end of 2025. In this environment, SJM incorporated L’Arc Hotel and Casino into its portfolio, making it the only satellite property absorbed directly rather than shuttered.

L’Arc Acquisition Drives Capital Needs

SJM completed the L’Arc purchase on December 15, paying HK$1.75 billion (US$224 million) to shareholders and assuming nearly HK$1.93 billion (US$247 million) of the property’s debt. Management views L’Arc as a strategic asset, enhancing SJM’s hotel and casino offerings while adapting to market consolidation. The bond issuance enables the firm to handle both the acquisition and refinancing obligations while preserving liquidity.

By raising new capital and extending debt maturities, SJM positions itself to navigate Macau’s evolving regulatory landscape while maintaining operational flexibility and growth potential.